When running a business, size can make a big difference. If you think you have a small business, you need to know what the government considers “small.” So, what is considered a small business by the federal government? Well, the small business definition depends on the federal agency. Read on to learn what is a small business.

What is considered a small business?

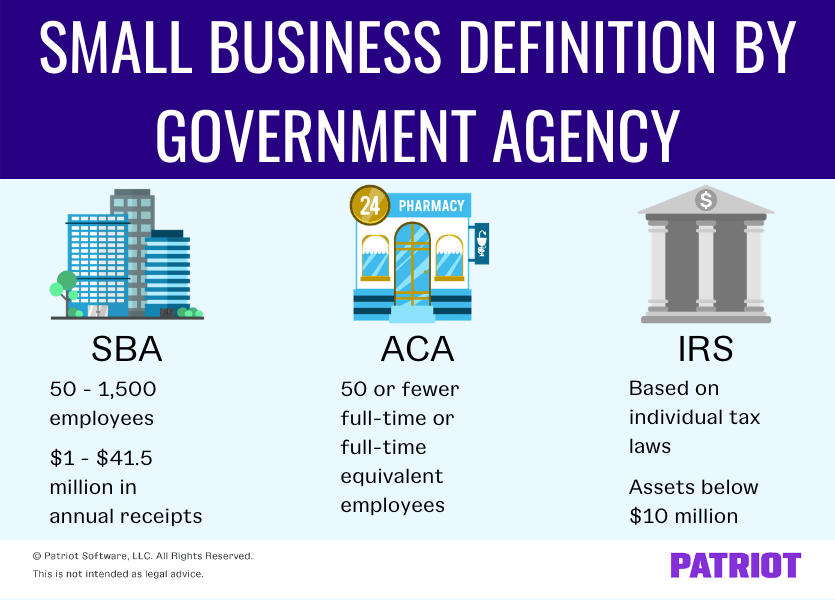

The Small Business Association (SBA), Affordable Care Act (ACA), and Internal Revenue Service (IRS) all have different definitions of what a small business is. Let’s take a closer look at what each agency considers “small.”

Small Business Association

The SBA classifies a business as small based on the business’s number of employees or amount of annual receipts.

To determine the size of your business, you must include the employees or receipts of all affiliates. Affiliation is based on the external party’s power to control, regardless of if the affiliate exercises the right of power or not. Power to control exists when an external party has:

- 50% or more ownership in the business OR

- Less than 50% ownership but still owns a larger share than other parties

Calculating annual receipts and employees

Calculate your business’s annual receipts by adding your business’s total income to your cost of goods sold. You can find these on your business’s IRS tax returns. Average the receipts over three to five years. If your business has not been open for five years, multiply the average weekly revenue by 52.

To calculate your number of employees, add up all employees for all pay periods over your business’s previous 12 calendar months. The SBA requires employers to count all employees, even if they are part-time or temporary employees. Include terminated employees in your calculation. If your business has been open for less than 12 months, average the number of all employees for each pay period that your business has been open.

The SBA also considers the industry when determining the size of your business. You can use the SBA size standards tool to help determine the size of your business.

SBA size standards

Again, what the SBA considers a small business can vary depending on your industry. However, the typical range is:

- Between or below 50 and 1,500 employees AND

- Between or below $1 and $41.5 million in annual receipts

To be considered a small business by the SBA, your company must also:

- Be for-profit of any business structure (e.g., S Corp or LLC)

- Be independently owned and operated (no parent company)

- Not be nationally dominant in your field (cannot own the majority of the market share)

- Be physically located and operated in the USA or its territories

The SBA reviews size standards every five years. The standards impact if your business can participate in government contracting programs and compete for the contracts set aside for small businesses. Your business size can also determine your eligibility for an SBA loan (e.g., PPP loan).

Check the SBA’s website regularly for any size standards updates.

Affordable Care Act

The ACA’s definition of a small business is different from the SBA’s. The ACA requires employers to include both full-time and full-time equivalent (FTE) employees when calculating the total number of employees.

The ACA considers a company with 50 or fewer employees to be a small business. Small businesses can qualify for the Small Business Health Options Program (SHOP).

Full-time employees include employees who work an average of 30 hours per week or 130 hours per calendar month. If you have part-time employees, you need to calculate full-time equivalent employees.

You can calculate your number of FTEs by multiplying your total part-time employees by the total number of hours worked by all part-time employees during the period. Divide your total hours worked by part-time employees by the minimum number of full-time hours for the period (e.g., 30 hours X 4 weeks for a month) to get your company’s total FTEs.

Add your total FTEs to your total standard full-time employees to calculate the total number of employees. If your business has 50 or fewer employees, you are a small business according to the ACA.

The ACA also has a full-time equivalency calculator to help you determine the number of applicable employees.

Why does the size of the small business matter to the ACA? Your business size determines if you have to offer health coverage to your employees.

Businesses with fewer than 50 employees

Again, you are considered a small employer with the ACA if you have 50 or fewer full-time or FTE employees. So, what does that mean for your business? It means:

- You may be eligible to purchase insurance through the SHOP Marketplace

- Your business is not subject to the employer-shared responsibility provisions of the ACA

- You may be eligible for tax credits if you meet certain conditions

So, who is eligible for the SHOP Marketplace, and what are the conditions for tax credits?

SHOP Marketplace eligibility

The ACA requires employers to meet four requirements to offer SHOP health insurance:

- Have 1 – 50 FTE employees other than owners, spouses, partners, or family members of owners

- Offer health insurance to all full-time employees

- Meet the minimum enrollment (typically 70% enrollment rate, but varies by state)

- Have a work location or office in the state whose SHOP you use

Tax credits

Some employers may be eligible to receive healthcare tax credits if they meet certain conditions. The conditions include:

- Covering at least 50% of the employees’ premium costs

- Having fewer than 25 FTEs

- Paying average annual wages per FTE employees of less than $53,000 per year

- Purchasing coverage through the SHOP Marketplace

ACA tax credits are based on the number of employees you have or the average amount of wages paid to your employees. The IRS issues the tax credits and uses a sliding scale to determine the amount of tax credits you can receive. The smaller the size of your business, the bigger the credit. The larger your business is, the smaller the credit. However, there is a maximum credit you are eligible for, no matter the size of your business. Maximum credits include:

- 50% of premiums paid for small businesses

- 35% of premiums paid for tax-exempt businesses

Credits are only available for two consecutive taxable years and are refundable. Employers may receive a refund if they are tax-exempt and have no taxable income. Tax-exempt employers only receive credits if their refund does not exceed their income tax withholding and Medicare tax liability.

Businesses with 50 or more employees

Under the ACA, if your business has 50 or more full-time equivalent employees, you are an applicable large employer (ALE). ALEs with exactly 50 full-time or FTE employees can use the SHOP Marketplace.

In some states, ALEs with up to 100 employees may be able to use the SHOP Marketplace. Contact your state or the SHOP Marketplace to determine your eligibility.

Internal Revenue Service

The IRS does not have a standard of what is a small business. Instead, the IRS uses individual tax laws to determine what a small business is. Businesses that file the following forms may be considered a small business by the IRS:

- Form 1040 or Form 1040-SR

- Schedule C, E, or F

- Form 2106

Businesses with assets under $10 million are also considered a small business by the IRS.

Use the IRS’s Small Business and Self-Employed Tax Center as a resource to understand your responsibilities.

This article has been updated from its original publication date of July 14, 2017.

This is not intended as legal advice; for more information, please click here.