Maybe you had a commercial property for your business and closed it up to work out of your home and save on overhead. Or, perhaps you’re just starting out and want to set up a home-based business and see how things go. But, what if you rent? Can you run a business out of an apartment, condo, or rental home?

Before running a business out of a rental home or owned properties with a condo or homeowner’s association, understand limitations, steps for compliance, and alternatives.

Can you run a business out of an apartment?

You might be asking yourself, Can I run a business out of my apartment? Or, maybe you decided to just do it, going with that “It’s easier to ask forgiveness than it is to get permission,” mentality.

At the same time, you probably want to avoid getting a “cease and desist” letter from your landlord or condo/homeowner’s association (think “Michael Scott Paper Company”). That’s why the question you should be asking is: Is it legal to run a business from an apartment?

So, here’s the bottom line:

- The Question: Can you run a business out of a rental property or owned property with an association?

- The Answer: Yes and no. The key to legally running a business from rented property is communicating with your landlord and understanding limitations.

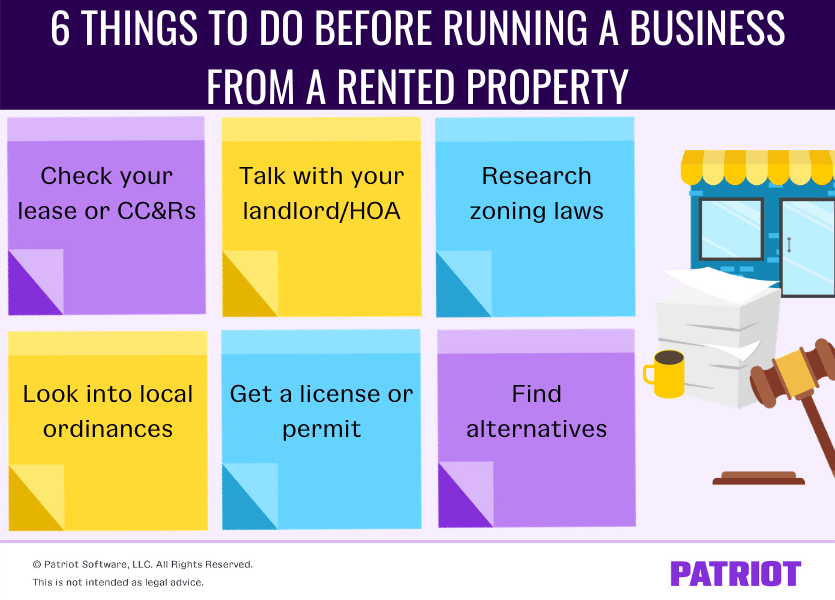

Running a business from a rented property: 6 Steps

You’ve heard the famous tales of entrepreneurs who started their business in a garage (e.g., Jeff Bezos of Amazon), attic, living room, etc. You may even know fellow business owners who run their companies out of their homes.

But, what did they do to get there? Here are six steps you may need to take to legally run your business from your residence.

1. Check your lease or CC&Rs

When you rent a property, you receive a lease agreement that lays out what you can and cannot do. Likewise, if you buy a property with a homeowner’s association (HOA), you receive CC&Rs (Covenants, Conditions, and Restrictions) with rules.

Take it from John Ross, CEO of Test Prep Insight, who started his company out of a rented condo:

If you are an entrepreneur thinking about launching your business out of your rented apartment, condo, or house, the first thing you need to do is check the terms of your lease agreement. Many leases ban the use of the premises for business purposes, and allow rentals to be used only for ordinary residential purposes—so make sure you confirm you’re free and clear to run a business out of the unit. Likewise, if you have renter’s insurance, make sure to check your policy, as sometimes running a business out of the home can void your renter’s insurance coverage.”

What does your lease or CC&Rs document say about running a business from your place of residence? Does it state you cannot run a business from your home? Or, are there rules that your business could wind up breaking (e.g., rules against disturbing other residents). If so, you may consider talking with your landlord or association to see if you can work something out.

Sometimes, interpreting what the documents say can be difficult. Prohibiting you from running a business might not be explicitly laid out. Instead, there might be confusing language that bans a home-based business but doesn’t clearly state it, which is why you must…

2. Talk with your landlord or HOA

Even if everything else checks out, you need to talk with your landlord or HOA about your plan to run a home-based business. They likely want to verify that your business won’t cause a disturbance to other tenants or damage the property.

Your landlord or HOA might require a written notice before giving you permission to run your business out of your residence. For example, you may need to detail:

- What your business is

- Business hours of operation

- Any commercial vehicles you plan to purchase

- Signage (e.g., advertisements in your windows or yard)

- The number of employees working out of your residence

When getting permission, be upfront. Like giving an investment pitch, be thorough and show your landlord or HOA that you’ve thought over everything.

3. Research zoning laws

Zoning laws are regulations that divide areas of land by residential, business, and/or commercial use. These laws aim to promote the health, safety, and welfare of community members by limiting where businesses can operate.

Before running a business from a residential area, consult your local government’s zoning laws. Your locality may ban the use of residential property for business purposes.

4. Look into local ordinances

Does your locality have any ordinances that could impact your ability to conduct business from a residential area?

Examples of ordinance limitations include:

- Number of employees you can have

- Insurance requirements

- Amount of traffic

- Signage

- Parking bans in certain conditions

Look into local ordinances. You can contact your locality or look on their website. Compare any ordinances with your business plans to determine if you can proceed.

5. Get a license or permit

Do you need a license or permit to run your business out of your home? Required business licenses and permits for operating out of an apartment or home vary based on your:

- State or locality

- Industry

Contact your state or local government office to find out what licenses and/or permits you need (if any) to avoid penalties, fees, or getting shut down.

6. Find alternatives

Not the outcome you were hoping for? No worries. There are a number of alternatives to running a business from a rental property.

You may consider not renewing your lease at the end of your term. Or, you could break your lease early and work out something with your landlord. This would give you the freedom to find a new residence that you can live in and conduct business from.

If you don’t want to move and don’t want to get a commercial property for only your business, you can think about getting a “coworking space” (e.g., WeWork).

Approved to run your business from a rental? Do this next

Once you learn that you can run your business from a rental, the fun begins. Now, you can start thinking about what it’ll look like to actually run your business out of a rental space.

Here are a few actions you can take to increase the probability of your venture’s success:

- Create a designated workspace

- Invest in stronger Wi-Fi, if applicable

- Bulk up security

- Claim the home office deduction

Create a designated workspace

Blocking off an area where you can work can help you stay organized and improve productivity. Not to mention, it makes it easier to claim the home office tax deduction (which we’ll get to later).

For example, you may turn your extra bedroom into your business workspace. Or, you could opt to work out of your garage. Whatever you decide to do, clearly define the areas of your home used for living and working.

Invest in stronger Wi-Fi

You’re on a video chat with a potential client, and then … your Wi-Fi goes out. You scramble to get back up and running, but it’s too late. You’ve lost your window.

Of course, there are things beyond your control that can lead to internet disconnection (e.g., storms, construction, etc.). But if you get a reputation of having poor Wi-Fi, your current and potential clients could start questioning your credibility.

Consider upgrading your Wi-Fi when you start a home-based business to help avoid disruptions due to weak signals.

Bulk up security

Running a business out of your home may be more convenient, less expensive, and easier to manage. But, that doesn’t mean you skimp out on key protections, like security.

Nearly half (43%) of all cyberattacks target small businesses. And, 60% of small businesses that are victims go out of business within six months.

Working out of your apartment, condo, or home is no exception.

Security breaches can lead to issues like unemployment fraud and business identity theft.

To protect your business, customers or clients, and employees (if applicable), take measures to increase cybersecurity. For example, you can invest in antivirus protection and cybersecurity training.

Claim the home office tax deduction

After your landlord OKs your home-based business, the IRS may let you claim a tax deduction to deduct expenses associated with your business.

The IRS home office tax deduction is available for qualifying business owners who exclusively and regularly conduct business out of their home.

A home includes:

- House

- Apartment

- Condominium

- Mobile home

- Boat

- Other structures on the property (e.g., unattached garage, barn, etc.)

For more information on this tax deduction, check out the IRS’s website.

This is not intended as legal advice; for more information, please click here.