The primary benefit that attracts many business owners to become an S Corp for tax purposes is straightforward—it can potentially save them money.

However, before making any changes to (or forming) a business entity that will have legal or tax implications, entrepreneurs should weigh all pros and cons with a tax advisor and attorney. There are many factors to consider when altering a business structure or how taxes are handled.

The information that I will share in this article is not meant to be legal or tax advice but rather some general information about the possible benefits of forming an S corporation and how to become an S Corp. I’m going to focus on what’s involved in converting an LLC to an S Corp, and then I’ll touch on converting a C Corp to an S Corp. (Sole proprietorships and partnerships must first form an LLC or incorporate before they can elect for S Corp tax treatment.)

LLCs and S Corp election

By choosing S Corporation election with the IRS, LLC owners reduce their self-employment tax liability. The IRS treats both the LLC and S Corp as pass-through tax entities, but there’s a difference in how compensation is paid to owners.

Generally, with the LLC structure, LLC owners (members) pay themselves through owners’ draws. But by electing S Corp tax treatment and putting themselves on the company payroll, LLC members can lower their self-employment tax burden. Rather than paying federal income tax and self-employment tax on all of the company’s taxable income (as is the case with a sole proprietorship, partnership, or LLC), an S Corp’s owners only pay self-employment taxes (Social Security and Medicare) on their wages and salaries. The remaining business profits, paid to owners as distributions, are not subject to self-employment taxes.

To be taxed as an S Corp, an LLC must…

- Put their owners on the company payroll.

- File the necessary IRS forms to become an S Corp.

1. Put LLC members on the company payroll

As I mentioned before, an S Corp must partially pay its owners through wages and salaries, which need to be at a reasonable rate for the market. Setting up payroll to have all taxes withheld and reported correctly can get a bit involved and confusing. You may consider payroll software to streamline your payroll responsibilities.

2. File the necessary IRS forms to become an S Corp

To get the benefits of an S Corp, an eligible LLC can apply for the election without changing its organizational structure to a corporation. That means its owners can reduce their self-employment taxes without taking on the extensive ongoing compliance requirements of a C Corp.

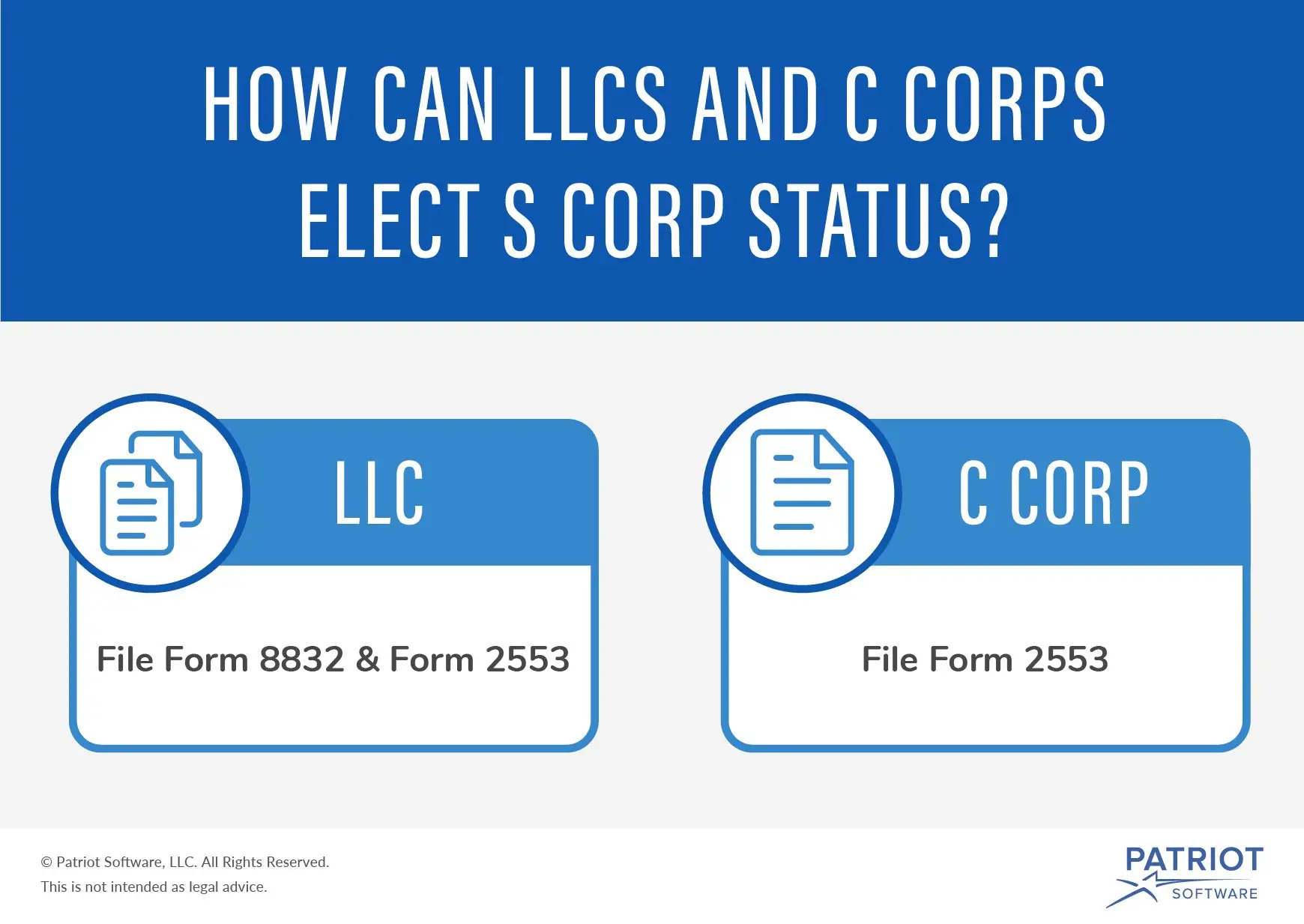

To elect for S Corp tax treatment, the LLC must file IRS Form 8832 (Entity Classification Election) and then Form 2553 (Election by a Small Business Corporation).

One way to ensure the paperwork gets completed correctly and on time is to use the services of an online document filing company, like CorpNet.

C Corp and S Corp election

C Corps already have payroll set up, so the S Corp benefit to them is avoiding double taxation. With usual C Corp tax treatment, the entity pays federal income tax on its income after allowed deductions, credits, etc. Then, the profit distributions it makes to shareholders (which aren’t tax-deductible business expenses) get taxed again at the individual shareholder level.

As an S Corp, the entity doesn’t pay income tax but rather the corporation’s profits pass through to its shareholders’ personal tax returns instead, thus eliminating double taxation.

To elect S Corp tax treatment, a corporation must submit IRS Form 2553. Again, consider opting for an online document filing company’s services.

How long does it take?

The interval for having S Corp election processed depends on whether the company is an existing LLC or corporation or a brand new entity that wants to file for S Corp election.

The state where the company is registered can affect the timeline, too. The processing period can range from two to 30 days. Sometimes, online filing companies offer a rush option.

These views are made solely by the author.