Finding success as a startup can be difficult. Most founders start their businesses with a desire to bring real innovation to their chosen fields. However, they meet a wide variety of challenges and risks from the get-go, and the margin for success can be slim.

Securing enough funds for payroll, product research and development, and marketing are challenges most founders expect and are prepared for. Many startups are also met with a wide variety of unexpected risks as well. Issues such as employment-related claims and lawsuits, unexpected property damage, contract breach or product failure lawsuits can and probably will happen, and it’s important for the success of your startup to be prepared for them by investing in the right insurance products. This will allow you to manage these risks, transfer their financial burden to the insurer, and help you survive and thrive despite them.

However, buying commercial insurance has, for the most part, been a fairly tedious process in general, and especially tough for startups. Most traditional carriers just don’t understand the needs of startups and don’t have the processes, programs, and policies that suit them.

Additionally, many startup founders feel that insurance is a luxury and not a necessity, and would prefer to leave it for later – when their business has grown so they can allocate more of their budget to it. However, this may prove to be a bad idea, since early-stage startups are especially vulnerable, and many may not have the financial strength to weather these risks and continue their normal operations.

To help startups who are looking to create a risk management program through insurance, we’ll cover what polices a quickly growing business would typically need and what each policy would bring to your business.

What policies do startups need?

There are many factors that determine the type of coverage you need in order to protect your startup properly.

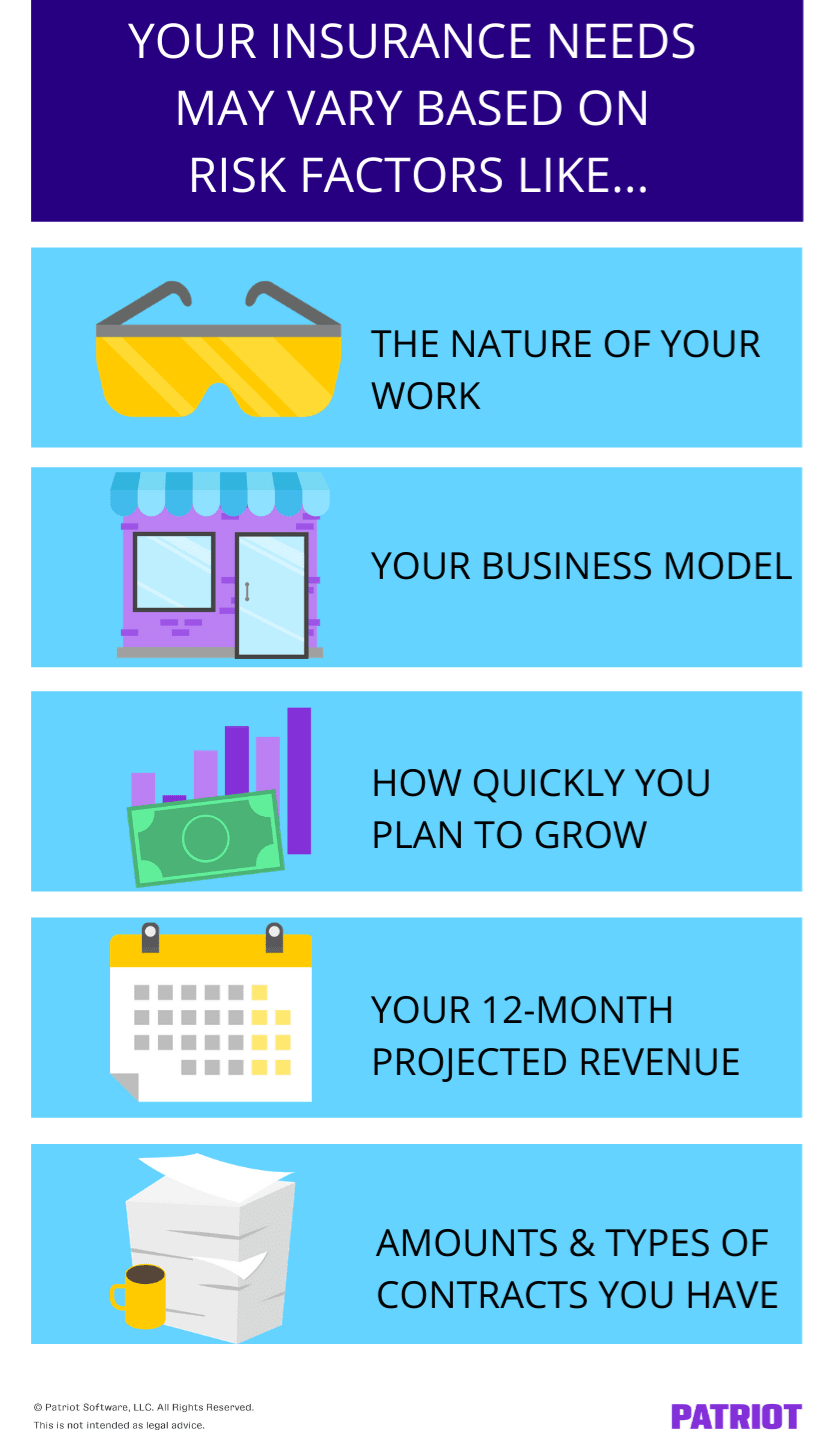

Some of the most common risk factors that brokers take into account when suggesting insurance include:

- The nature of your work

- The business model

- How quickly you plan to grow

- Your 12-months projected revenue

- The amount and type of contracts you have with partners and customers

These factors correlate well to the growth stage your startup is in, i.e., Seed stage, Stage A, B, C…, etc. So, we’ll break down what policies are typically suggested to startups as they move from one growth stage to the next.

Insurance for Seed Stage Startups, Pre-Customers

General Liability Insurance: This is a staple policy that will protect your company’s tangible assets, such as computers, tools or office furniture from loss. An important aspect of this coverage is that it will also cover you from claims of injury and property damage to third parties that happen on your property. If you’re leasing property or want to attend conferences, this policy is required.

Workers’ Compensation: If employees are injured while carrying out their duties, workers’ comp will pay for medical care and lost wages. The good news is that insurers typically see startups as low-risk businesses, so you won’t have to pay much. All states except Texas require you to carry this coverage.

Insurance for Seed Stage Startups, With Customers

Technology Errors & Omissions (E&O) Insurance: This policy is important because most startups rely on tech solutions to bring innovation to their industries. Insurers consider most technology-related products to be services, and a good E&O policy would respond to cover your company if your services or products do not perform the way they are promised to or cause damages to third parties.

Cyber Liability Insurance: If you store personal information on your networks, then you’re at risk of data breaches. A good cyber policy would cover both first-party costs of a data breach such as forensics, notification costs, and credit monitoring, as well as costs related to lawsuits from those who suffered damages from the cyber attack. Additionally, it should also cover regulatory fines and penalties imposed on you because of the data breach.

Insurance for Series A Startups

Directors and Officers (D&O) Insurance: This policy would come in to protect both the company and the personal assets of your executives and directors if they were sued for breach of fiduciary duty, misrepresentation, or mismanagement. It would cover both the defense costs and any settlement monies that you or they would be ordered to pay. The reason D&O insurance is so important for startups who are seeking funding is that most venture capitalists will want to serve on the board of directors of the startup they invest in—meaning they’ll want to know their personal assets are covered.

Employment Practices Liability Insurance (EPLI): This policy will protect your startup from employment claims, such as wrongful termination, harassment, or discrimination. Many startup founders don’t think they’re “big enough” to require this policy, however, nothing can be further from the truth. The exorbitant costs of one employee lawsuit can sink even the most stable business.

Key Leader Insurance: Key leader, also known as “key person” insurance, is basically a life insurance policy taken out on a person crucial for the success of the business. Key person insurance will ensure that your company is protected in the case of death or disability to a key partner, executive, salesperson or team member. It will cover both the incurred losses and replacement costs.

These views are made solely by the author.