Let’s face it, business is rarely convenient.

No one knows what tomorrow holds and, as a business owner, you need to be flexible enough to adapt to those changes as quickly as possible, not just to stay afloat but to take full advantage of moments of growth as well.

One way that can be is with a business line of credit, which offers unparalleled flexibility and dependability even when it comes to cutting-edge financing options.

With a business line of credit, you’re able to tap into the capital you need at a moment’s notice— whenever you need it.

Business lines of credit can help with:

- Buying extra material or inventory for a busy season

- Hiring and training new employees during expansion

- Renovating your location when you’ve gotten too big for your current place

- Improving business cash flow management

But exactly how does a business line of credit work and, most importantly, what can you do to increase your chances of qualifying for one with a lender?

How a business line of credit works

We touched on what a business line of credit is a moment ago. However, you should understand the basics not only so that you can decide if it’s an ideal option for you and your business but so that you know what you’re getting yourself into if you decide to do so.

A business line of credit works much like a credit card. For a monthly fee, you get access to a specified, revolving amount of credit.

The great part is, you can tap into that credit whenever you need: tomorrow, next week, or next month (or longer). Plus, provided you pay off the balance over time—typically with a six or 12-month repayment window—you can continue using that line of credit.

There are two main types of business lines of credit:

- Secured line of credit: These require collateral but have lower interest rates compared to unsecured lines of credit.

- Unsecured line of credit: These require no collateral but have higher interest rates compared to secured lines of credit.

Secured lines of credit are typically offered by traditional lenders and require stringent qualification guidelines, the most notable being good credit (660+ in many cases).

However, with the fintech boom have come new alternative lenders which take a more rounded approach to the qualification and approval process, which means you don’t need stellar credit if your business numbers add up.

How to qualify for a business line of credit

At this point, a business line of credit might sound quite useful as a vehicle for maintaining the necessary cash flow, both for business growth and stability.

But what do you need in place to qualify for a business line of credit? And what can you do to increase your chances of being approved and streamline the approval process? That’s what we’ll cover here.

Lenders look for businesses with a solid track record and who are well-established, as they want assurance you’ll be able to pay off the line of credit.

Having said this, it’s never been easier to qualify for a line of credit as even relatively newer businesses (just a few years in business or less) can be approved.

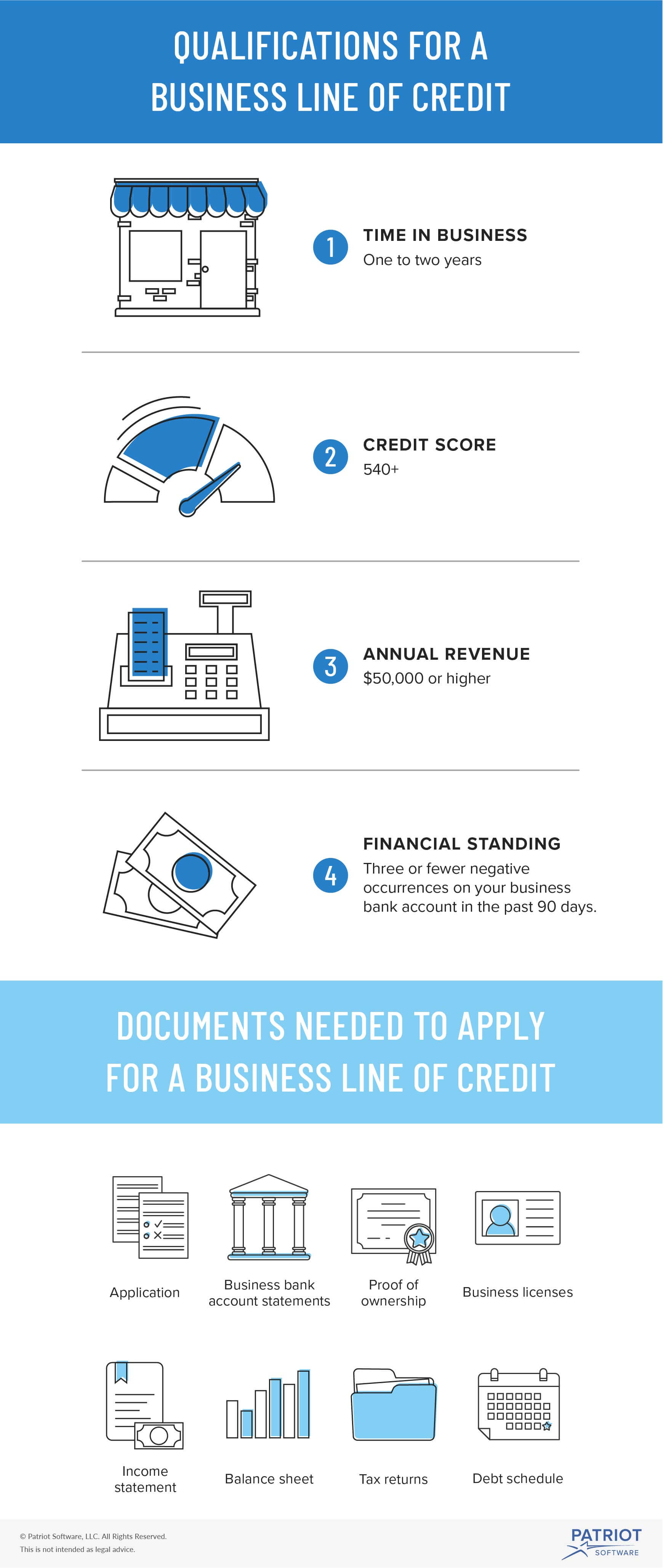

Here are the basic elements you need in place to qualify for a business line of credit:

- Time in business: one-two years

- Credit score: 540+

- Annual revenue: $50,000 or higher

- Financial standing: three or fewer negative occurrences on your business bank account in the past 90 days.

Keep in mind the qualification factors will differ depending on the lender, but they all have similar requirements.

In addition to this, what you’re approved for–including repayment terms and size of the credit line–will differ based on additional factors such as:

- Revenue

- Cash flow

- Debt

- Credit

However, as mentioned above, which of those factors is weighted more heavily (in particular, credit) depends on if you apply with a traditional lender such as a major bank or an alternative lender.

Applying for a business line of credit

Once you’ve gotten a grasp on the qualification guidelines for business lines of credit, it’s time to gather your documents and apply.

Keep in mind that only a few pieces of documentation will likely be required to apply.

These are the basic requirements to apply for a business line of credit:

- Application (most online applications take no more than a few minutes with 24-hour response and even funding)

- Past four-month business bank account statements

However, to be approved for a line of credit, several other documents may be requested by the lender after you submit your application. For that reason, you’ll want to have these documents ready in case they’re requested to streamline approval.

- Proof of ownership

- Business licenses

- Income statement

- Balance sheet

- Personal and business tax returns

- Debt schedule

With all the right documents in place and a healthy business forecast, many lenders can fund your bank account within 24-48 hours, which is why it’s important to have these documents on-hand in case you need the funds quickly.

A business line of credit offers unrivaled flexibility and power, especially for small business owners who may not know what lies around the corner (as none of us do).

For that reason alone, a line of credit is worth considering as a way to navigate the fluctuations of the seasons and stabilize business so you’re ready– no matter what happens.

These views are made solely by the author.