Over the years, more and more small business founders are turning to credit cards as a viable source for financing a new business. And it’s not hard to see why startup business credit cards have become so popular.

Thanks to the 2008 financial crisis, banks have become much more risk-averse, preferring to lend mostly to established businesses with a track record of success rather than new and untested enterprises.

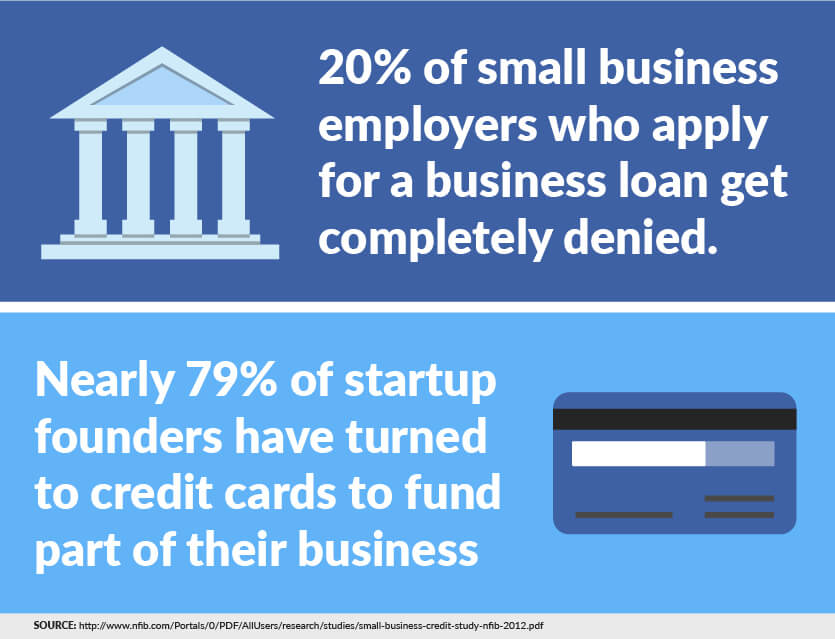

The National Federation of Independent Businesses reports that nearly 44% of business loan applicants got some (or none) of their target loan from banks. And, other sources of startup funding—like venture capitalists, alternate lenders, and development grants—are still very picky.

As a result, nearly 79% of founders have turned to credit cards to fund their businesses in some capacity.

The problem with business startup credit cards as funding

It’s true that credit cards can be a great source of capital for startup founders, offering the convenience of a revolving line of credit, lack of risky collateral, the possibility of rewards and low interest rates, and the chance to establish good business credit.

But all these perks obscure one fact: if you rely on your credit card as the primary source of funding for your startup, there is no room for error.

Consider the story of Philip Lindblom, CEO and founder of 1000 designers, who went through an extremely difficult and trying time when he funded his startup solely with credit cards. Due to a series of unforeseen setbacks that stifled revenue, Lindblom was unable to pay off his credit cards in a timely manner, and had to max them out one by one over a year’s time.

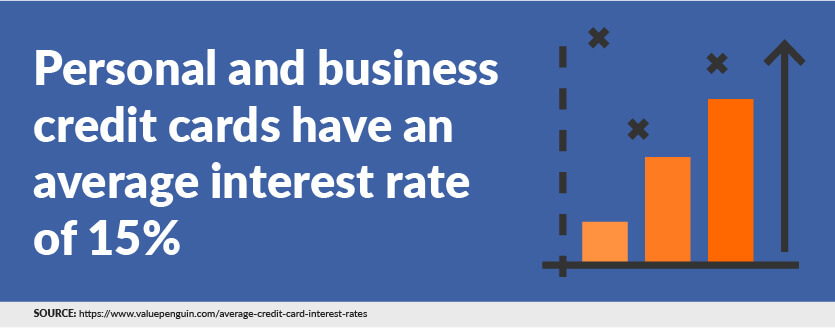

Unfortunately for Lindblom, credit cards—unlike small business loans, tax-exempt bonds, and other forms of business revolving lines of credit—have extremely unforgiving terms. Personal and business credit cards have an average interest rate of 15%, though this rate can be raised by card issuers due to factors such as exceeding payment deadlines by 30 days, defaulting on another account, or exceeding your credit limit. Note that annual percentage rates (APR) top out at a maximum of 30%, a rather large burden for overstretched entrepreneurs to bear.

Startup credit cards for small business may contain repossession clauses

Also, while credit cards are technically unsecured loans (not backed with collateral), some cards contain repossession clauses. In other words, if a cardholder defaults on payments, both personal and business property can be seized for the credit card issuer to recoup its losses. Thanks to the Consumer Financial Protection Bureau (CFPB), however, it’s easy to research repossession clauses online.

But there’s another, more troubling statistic: for every $1,000 of credit card debt, a startup’s chance of surviving decreases by 2.2%. While researchers found that credit card debt wasn’t the only factor that determined whether a firm would survive its first three years of operation, it was nonetheless a statistically significant one.

As for Lindblom, he faced debt collectors who tried to repossess his belongings, a shattered credit score, and an immeasurable level of stress, anxiety, and frustration.

How credit cards should be used to fund your business

That’s not to say that credit cards can’t be one source of funding for your business. When should you use a credit card to finance your business?

When using a business credit card to grow your startup, it’s best to stick with limited, low-risk amounts, such as using a charge card for a quick infusion of capital to pull off a business deal. This is only a stopgap measure, and the cardholder expects to pay off the charge when the deal is finalized.

Of course, each situation and startup is different. Credit cards offer startup founders a host of benefits for those who know how to use them wisely. Prudent use means researching the business credit cards on offer and choosing the one best suited for your needs.

Keep in mind that all the benefits and perks that come with using credit cards, from improved credit scores to frequent flyer miles, usually depend upon repaying the balance in full and in a timely manner.

So if you’re a startup founder who wants to retain equity while growing your company, it may make sense to turn to alternate lenders, and not business cards, as your primary source of capital.

These views are made solely by the author.